Taking a Look at 2023 - Mid Year

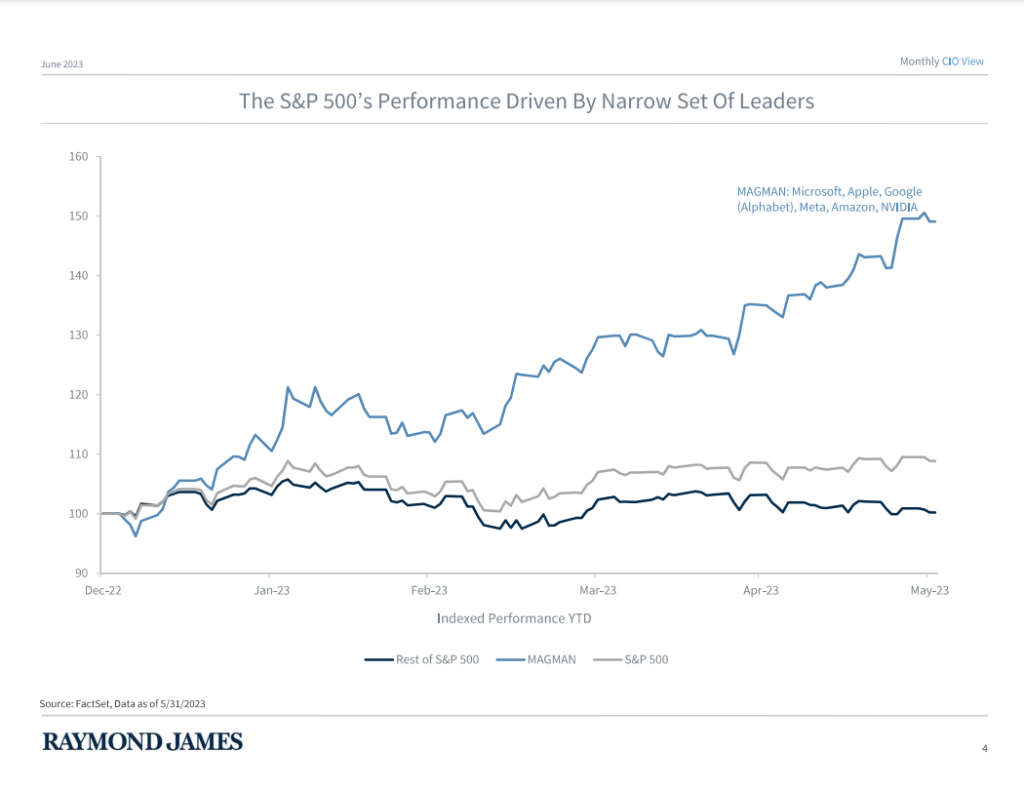

It was a 1st half of progress both in the bond market and the stock market. We are glad for it, but taking note of how narrow the stock market leadership has been. If you take a look at the attached chart, it shows how 6 stocks almost completely carried the S&P 500 (and the Nasdaq) for the 1st half. If we remove the 6-7 technology stocks that soared and look at the remaining S&P 493, we find a market that was flat and slightly down as of mid June. Not the worst thing, but not indicative of a healthy stock market.

Those 6-7 stocks are all in the latest theme to run upward: the focus on AI (artificial intelligence) related technologies. And I know: “This one has staying power”. . . I hear it frequently. I know for sure that AI does have staying power as the future of tech, but it would be defying history if these actual high flying stocks did not take a breather at some point and ease backward more than a little.

In the latter part of June, we saw much broader participation by the remainder of the market. This was good to see and is happening so far in July. A very interesting first few months of 2023 and it will also be interesting to see whether those high flyers come down to join the “rest of the crowd” or whether the crowd leaps upward to join the few.

Economic conditions continue to show a bit of disconnect – i.e. the financial markets not recognizing the slowing economic real world in which we find ourselves. So far, the Federal Reserve’s moves seem to be working, but another outcome that will only be seen in time is whether their efforts at raising rates and slowing the economy down are too much, not enough, or just right. (Difficult to see them being “just right”) We continue to follow multiple sources for analysis of the economy and markets when determining the most comfortable courses of action. Managing risk to the downside remains an important objective. . .Our goal is to avoid the big mistake or falloff.

In this first half:

Congress and our President signed legislation to raise our debt ceiling once again. This alleviated financial market anxieties for the short term, but it just cannot be good for our country (and many other countries, as well) to continue on this path. They can kick the can down the road for so long, but it only makes the eventual outcome more concerning rather than remedied. . .

As for the Fed moves, the economy has not yet felt the overall impact of these aggressive tightening measures. I believe that the impact will be significant and cause a further deterioration in earnings and economic growth during the 2nd half of 2023, likely leading to a recessionary environment (probably a given). This could be further exacerbated if the Fed remains too aggressive for too long, recognizing that an impact has already been felt within regional banks and the real estate market. Banks were our biggest 1st half disappointment. I read an interesting thought this week that even keeping rates UNCHANGED (where they are now) is still “tightening” because, over time, more and more loans become due and must be refinanced. Some businesses and investors were able to avoid the huge increase so far, but are in situations of upcoming realities in financing and refinancing as time goes on.

And with recession or economic slowdown:

Historically, stocks within sectors such as Health Care, Consumer Staples, Industrials, Utilities, and investment-grade fixed-income investments have fared relatively well during economic slowdowns leading up to and through recessionary periods. We are taking a look at these, among others.

As of midyear, a number of the major firms’ Chief Strategists have opinions that are either bearish or very skeptical that markets can maintain the positive direction. Sometimes this can be a contra-indicator, but I cannot help but feel like we aren’t done yet with market challenges. While one doesn’t need to understand the analysis behind an inverted yield curve, it is generally known to be an indicator that is followed by a recession. We are currently experiencing the steepest inverted yield curve in 40 years.

The FED’s job has been made tougher by some stubborn inflation indicators – such as the strong job market and wage growth – that have not yet responded to the significant move in rates. But those may have their turn coming down. As I have said over the last 6-9 months, rarely have strategist had such diverse opinions on whether an economic slowdown will occur at all, and whether it will be severe or modest.

We continue to watch things closely and evaluate the risks vs. rewards.

With good regards,

Key

Investment Advisory Services are offered through Raymond James Financial Services Advisors, Inc. Ascent Wealth Advisory, LLC are not registered broker/dealers and are independent of Raymond James Financial Services.

Any opinions are those of the author and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. The information provided does not purport to be a complete description of the securities, markets, or developments referred to in this material. Past performance does not guarantee future results.

Sector investments are companies engaged in business related to a specific sector. They are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

The NASDAQ composite is an unmanaged index of securities traded on the NASDAQ system.