A Brief Market Update Before Interesting Times Ahead

We have seen a broadening out of performance in the market more recently. The Magnificent 7 have had a modest reality check and the rest of the market . . .the S&P 493 as we call them. . . have had a generally decent run and are showing some catch-up. This was expected, but we simply didn’t know in what timeframe. The behavior of just a handful of stocks has been at an extreme over the last year or so. Without predicting what is next, it is healthy to see broader “normalcy” enter back into things.

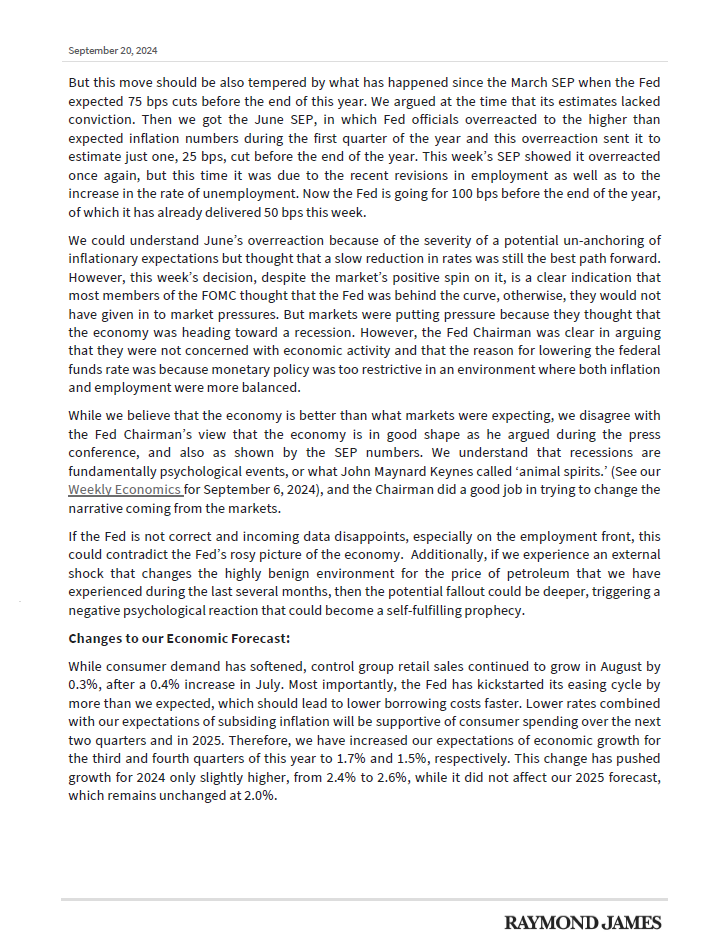

The FED is a much maligned and criticized group of people. I happen to think they have done a meaningfully good job over the last several years at managing interest rates and the economy. They were late to begin raising rates again, but they certainly made up for lost time in 2022.

There remains a continued risk of volatility as we work through these times leading up to the election and beyond. We have mentioned a number of times that the outcome of a presidential election has rarely been bearish, no matter who wins. The market tends to shrug off the outcome. More than ever this year, I believe the next month or two of economic indicators will be what truly impact the markets for the longer term – the next 6-12 months. Interesting times ahead, no doubt. And I tend to have opinions on a lot of things. However, I really have no feeling about this election outcome. Difficult to tell. Like everyone, I will be so interested to see the result.

This year has, to date, turned out to be a fairly quiet, non-volatile, upward year. This is rarely what is predicted. . .but I will take it most anytime.

Also, I have attached a brief report that is more “economy” than “stock market”. . .but holds some interesting information and, of course, the two are not at all unrelated.

Key

Investment Advisory Services are offered through Raymond James Financial Services Advisors, Inc. Ascent Wealth Advisory, LLC are not registered broker/dealers and are independent of Raymond James Financial Services.

Any opinions are those of the author and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected.