Reports and Market Thoughts for late October

Always sharing a variety of thoughts and hopefully useful material. . . Today, a few more of my own thoughts for those that want to know and sometimes ask for them.

Attached is our latest Investment Strategy Outlook and also this week’s Economic snapshot/commentary I thought worth forwarding.

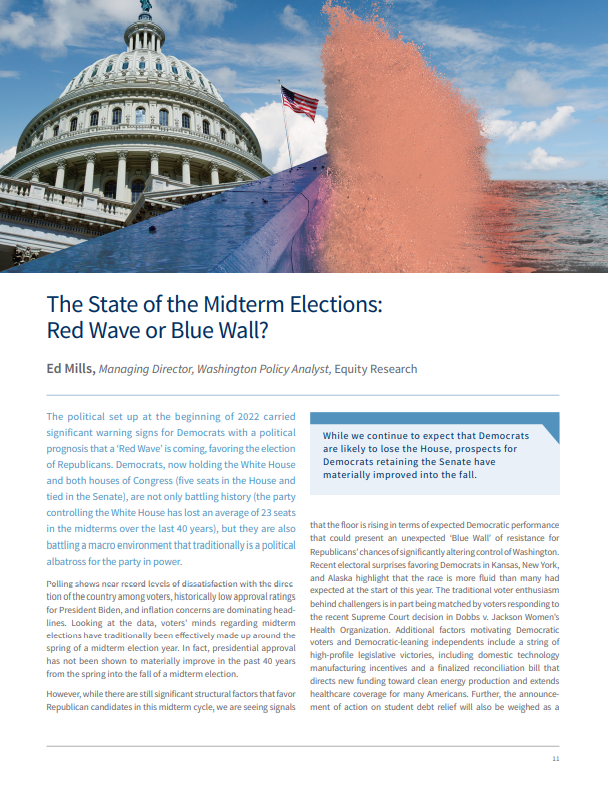

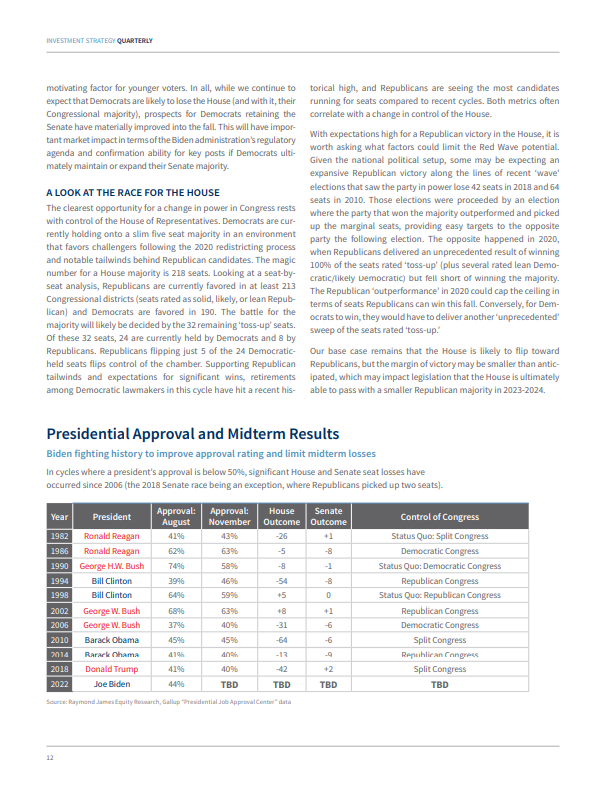

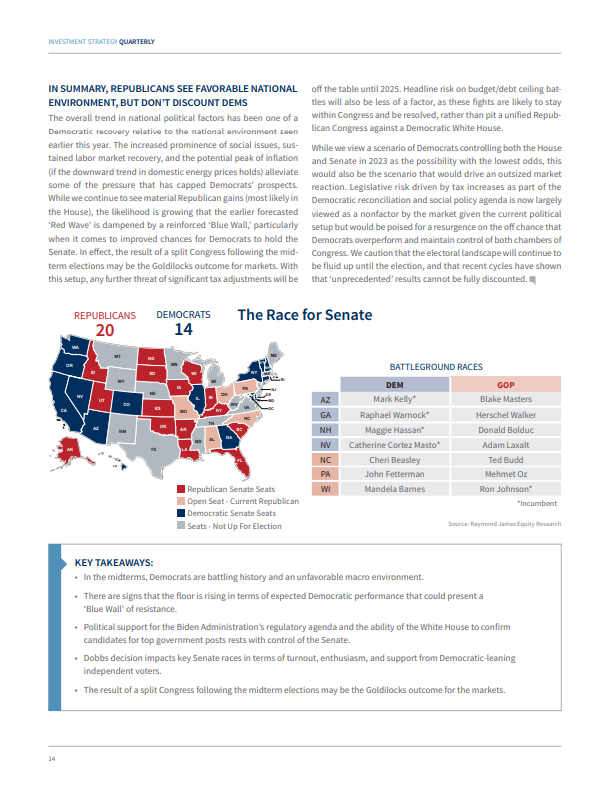

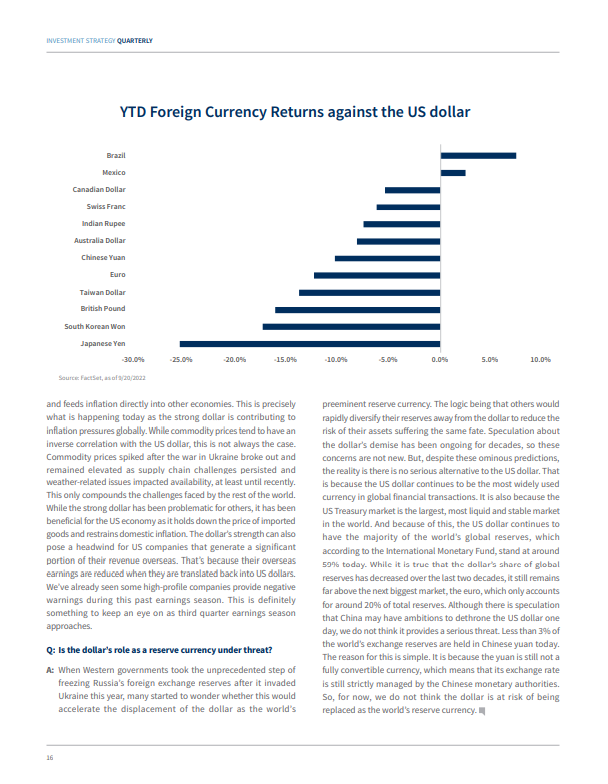

The Investment Strategy report does an excellent job of describing the current picture of things both domestically and globally. . .and then laying out what might happen in the financial markets. It also includes some commentary related to the upcoming elections.

Alas, a quick summary of recent history: We experienced a substantial boom period of time after the lows of 2008-2009. Investors benefitted greatly all these years, even while many spent a number of the years second-guessing whether the market would sustain. There was talk of “doom”, doubt, and inflation the entire way up. All 11+ years.

For the last couple of years, we commented several times about the “everything rally”. These recent years have been fun as practically everything was rising in values – homes and vacation real estate, cars, art, crypto, NFTs (whatever those are, still) and the list goes on. I began to question it. And we also commented to the effect it wouldn’t last forever and more challenging days would come around, though we certainly didn’t know when. We can always fill in the blank with the “reasons” for a bear market but, as long-term investors, we should know that boom times are followed by challenging times. . . and then challenging times do pass. Those that hold steady, avoid panicking, and even find ways to take advantage of opportunities are the ones that will win out the most when things rebound. We may be on the cusp of a recession (Really feels like we are already in one, doesn’t it?). But as has come up in my discussions with several of you, a market seeing a recession ahead typically (meaning: historically) has hit its lowest points at or near the BEGINNING of the recession, rather than in the middle or when the economy is recovering.

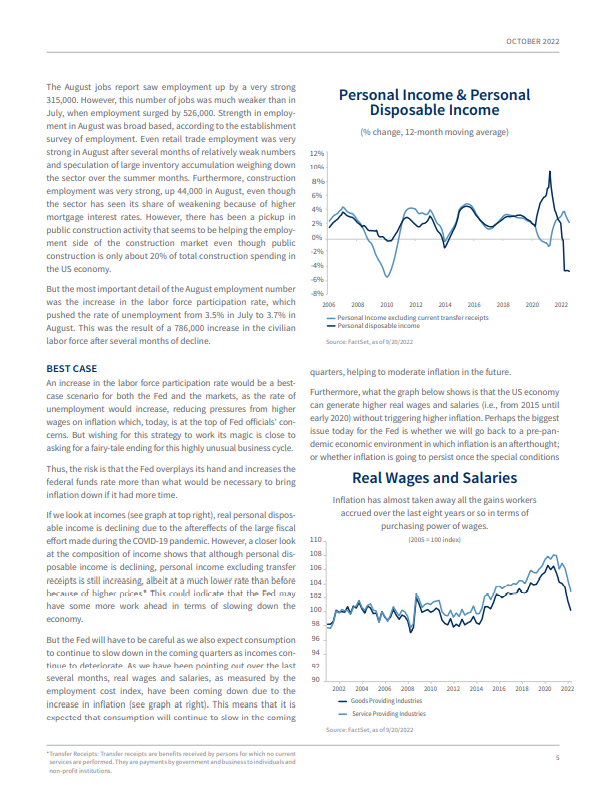

In our present day, the Federal Reserve is in the process of engineering a recession and an increase in unemployment because that is what it takes (they say) to prevent runaway price inflation. So while there is much debate, it is fairly clear that a slowdown is coming and, in several ways, is already here. True to form, the market has been struggling.

Yet the goals of the Fed’s moves are not accomplished. The labor market remains tight, wages are still up, consumer spending stubbornly strong. I admit I do not do much grocery shopping, but I still see prices of just about everything but gasoline remaining elevated.

I remember Alan Greenspan used to say that it takes 3-4 months for a rate change to have its effect. . .so we should see it, but it is taking time. The Fed will pause at some point and these rate increases will work – It simply takes time. I have mentioned several times about an unforeseen event that could rattle things in a major way – That possibility always exists. The global picture is somewhat fragile. However, absent that type of event and within the parameters of a recession/economic slowdown, I encourage folks to understand the wonderful time of investment bargains that exist. Unusually so, we have tremendous bargains in the Bond world – with high quality bonds beaten down and YIELDS not seen in many years. We can finally make money with our “safe” money again.

As a commentator on CNBC said this week: “These are complicated times.” That is no lie. However, the markets are down substantially with no place to hide and they will work their way through this complicated time and should end up better off – whether that is sooner or later. Until then, we will continue to navigate with care, diversification, and an eye to where the opportunities are compelling enough to act upon.

Wishing you well as November approaches.

Best regards,

Key

Investment Advisory Services are offered through Raymond James Financial Services Advisors, Inc. Ascent Wealth Advisory, LLC are not registered broker/dealers and are independent of Raymond James Financial Services.

Any opinions are those of the author and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected.